Variable Cost Formula Managerial Accounting . variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. variable cost formula. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. As production increases, these costs. since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. a variable cost is any corporate expense that changes along with changes in production volume.

from www.educba.com

since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. variable cost formula. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to.

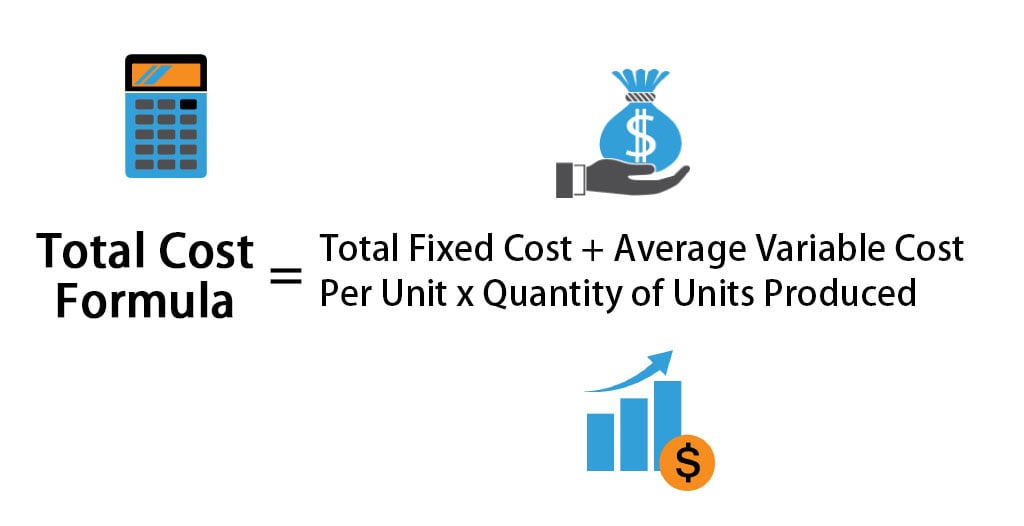

Total Cost Formula Calculator (Examples with Excel Template)

Variable Cost Formula Managerial Accounting To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. a variable cost is any corporate expense that changes along with changes in production volume. the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. variable cost formula. As production increases, these costs. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for.

From www.pinterest.com

Image result for Classifying Costs managerial accounting Managerial Variable Cost Formula Managerial Accounting As production increases, these costs. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. To calculate the total variable costs for a business you have to take into account. Variable Cost Formula Managerial Accounting.

From aprende-historia.com

Cómo calcular el costo variable de un producto o servicio Aprende Variable Cost Formula Managerial Accounting since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. As production increases, these costs. by performing variable cost analysis, a company can easily identify. Variable Cost Formula Managerial Accounting.

From discover.hubpages.com

Managerial Accounting Basic Cost Concepts HubPages Variable Cost Formula Managerial Accounting a variable cost is any corporate expense that changes along with changes in production volume. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for.. Variable Cost Formula Managerial Accounting.

From www.educba.com

Total Cost Formula Calculator (Examples with Excel Template) Variable Cost Formula Managerial Accounting variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. a variable cost is any corporate expense that changes along with changes in production volume. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to.. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Managerial Accounting Calculate Total, Prime, and Conversion Cost Per Variable Cost Formula Managerial Accounting by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. As production increases, these costs. since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. variable costing is a concept used in managerial and cost accounting in. Variable Cost Formula Managerial Accounting.

From learn.financestrategists.com

Operating Formula Calculation Finance Strategists Variable Cost Formula Managerial Accounting To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. by performing variable cost analysis, a company can easily identify how scaling or decreasing output. Variable Cost Formula Managerial Accounting.

From wise.com

Variable Cost Definition, Formula and Calculation Wise Variable Cost Formula Managerial Accounting by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. variable cost formula. As production increases, these costs. a variable cost is any corporate expense that changes along with changes in production volume. To calculate the total variable costs for a business you have to take into account. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Fixed and Variable Costs (Cost Accounting Tutorial 3) YouTube Variable Cost Formula Managerial Accounting variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable cost formula. As production increases, these costs. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. the cost equation is a linear equation that. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Managerial Accounting Full and Variable Costing YouTube Variable Cost Formula Managerial Accounting the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. Variable Cost Formula Managerial Accounting.

From www.pinterest.com

Image titled Calculate Variable Costs Step 9 Economics Lessons, Fixed Variable Cost Formula Managerial Accounting the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. variable cost formula. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. As production increases, these costs. Variable costing accounting is calculated as the. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Types of Costs Managerial Accounting YouTube Variable Cost Formula Managerial Accounting To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. As production increases, these costs. variable cost formula. a variable cost is any corporate expense that changes along with changes in production volume. the cost equation is a linear equation that takes into consideration total. Variable Cost Formula Managerial Accounting.

From www.vrogue.co

Variable Costs Definition Calculation And Examples Br vrogue.co Variable Cost Formula Managerial Accounting variable cost formula. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. As production increases, these costs. a variable cost is any corporate expense that. Variable Cost Formula Managerial Accounting.

From www.educba.com

Variable Costing Formula Calculator (Excel template) Variable Cost Formula Managerial Accounting variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Cost Classifications Managerial Accounting Fixed Costs Variable Variable Cost Formula Managerial Accounting the cost equation is a linear equation that takes into consideration total fixed costs, the fixed component of mixed costs, and. by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Fixed Cost Vs Variable Cost Difference Between them with Example Variable Cost Formula Managerial Accounting by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. As production increases, these costs. variable costing is a concept used in managerial and cost accounting in. Variable Cost Formula Managerial Accounting.

From www.educba.com

High Low Method Calculate Variable Cost Per Unit and Fixed Cost Variable Cost Formula Managerial Accounting by performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. To calculate the total variable costs for a business you have to take into account all the labor and materials needed to. As production increases, these costs. variable cost formula. the cost equation is a linear equation that. Variable Cost Formula Managerial Accounting.

From www.graduatetutor.com

Differences between Financial Accounting and Managerial Accounting Variable Cost Formula Managerial Accounting since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the.. Variable Cost Formula Managerial Accounting.

From www.youtube.com

Managerial Accounting and Cost Concepts Part One Classification of Variable Cost Formula Managerial Accounting since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc), the simplest formula for. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable cost formula. As production increases, these costs. To calculate the total variable costs for. Variable Cost Formula Managerial Accounting.